Building a Bridge of Appreciation to the Future of Creativity

written by Monk Antony Bur...

By Monk Antony

The legacy art world and NFT art world “run parallel to each other; there is no bridge between them” said author and art market economist Magnus Resch at NFT.NYC 2022. While this black and white pronouncement belies the nuance of the issue, the fact remains that as of this writing the worlds are largely separate. How then can a bridge (or bridges) be built between these two worlds to facilitate communication, understanding and establish common ground?

Between 2022’s Art Basel Hong Kong/Basel, NFT.NYC, and Proof of People (London), generative art, specifically on fxhash, has witnessed its coming out party. Four of the world’s most impactful cultural hubs across three continents hosted events in quick succession with fxhash-based generative art featuring prominently.

The generative art community (GAC) and the legacy art world (LAW) have a dysfunctional relationship. These four events, however, which featured fxhash artists’ works side by side modern and contemporary titans, panels, exhibitions, live minting, auctions, and informal community gatherings, have facilitated the construction of a cultural bridge between the nascent NFT GAC, LAW buyers and the LAW’s dealers and auction houses. I was fortunate enough to attend one of these events in person, Art Basel Hong Kong (ABHK).

A Bridge to Legacy Art World Buyers

“That’s so cool. I need to tweet about this,” gushed a Tezos APAC team member as I showed her the interactive features of Marcelo Soria-Rodriguez’s el inefable momento, mintable from fxhash’s “Live Generative Gallery” at ABHK.

This reaction was largely indicative of the public’s response to the Tezos x ABHK “NFTs + the Ever-Evolving World of Art” exhibit, which aimed to demystify the world of NFT art collecting.

Hundreds of eager attendees minted their very first NFTs at the event. These included casual art appreciators, buyers, and even celebrities like Vivienne Tam, the New York/Hong Kong-based fashion icon, who giddily showed me her Herbarium mint by Aleksandra Jovanić, explaining it was her first NFT and the artist she was hoping for.

Onboarding at this scale is only possible if the tech is approachable. The Tezos APAC team succeeded with a simple minting process consisting of a QR code scan and three taps on a smartphone to both set up a Kukai wallet and mint a work of art. Since 62% of LAW buyers are aged between 40 and 64, a critically important element to bridging the cultural gap with buyers is simplifying the process for the less tech savvy. For these potential buyers, setting up an account with an exchange, connecting to a fiat on-ramp, purchasing a crypto currency, setting up a wallet and maintaining wallet security remain considerable barriers to entry. Elegant minting approaches as demonstrated at ABHK play a foundational role in increasing inclusivity.

The mintable artwork itself featured new collections from eight of fxhash’s and generative art’s most notable artists: Yazid, Ryan Bell, Aleksandra Jovanić, Jinyao Lin, Lunarean, Sarah Ridgley, Marcelo Soria-Rodriguez and Aluan Wang (ileivoivm). Lucky attendees could acquire a random piece for free despite the fact that this illustrious lineup’s work would have sold out within minutes for tens of thousands of Tezos if released on fxhash. This contrast only highlights the efficiency and robustness of the global NFT market, fxhash specifically, compared to even world class but geographically limited art fairs.

Art fairs such as Art Basel do, however, present the opportunity to juxtapose physical and digital work in the same space. Seeing pieces from the roughly six-month-old fxhash alongside works by Josef Albers, Dan Flavin, Keith Haring, Banksy, Takashi Murakami and Damien Hirst put the accomplishments of the young platform into perspective, raising both the awareness and legitimacy of the work produced there.

While events like ABHK facilitated the onboarding and legitimization of fxhash’s generative art in the eyes of LAW buyers, the LAW’s institutions remain wary, divided and skeptical.

A Bridge to Legacy Art World’s Auction Houses and Dealers

Despite NFT capital enticing some of the legacy art world’s (LAW) largest institutions such as Art Basel, Christie’s, Sotheby’s and Phillips, many in the dealer sector remain suspicious.

Flow of capital in the LAW exerts considerable influence, especially with an industry still struggling to find its footing after a disastrous two-year pandemic accounted for 2020’s biggest fall in sales in 10 years. Further, individual buyer numbers have been declining since 2016.

Meanwhile, according to 2022’s “The Art Basel and UBS Global Art Market Report”, NFT sales increased “over hundred-fold in 2021 year-on-year reaching $2.6 billion” with 74% of high net worth collectors acquiring art as an NFT. It is no coincidence that large auction houses have embraced NFTs as a category so aggressively in order to increase sales, expand their declining buyer bases and widen their geographical reach.

This acceptance was reinforced at ABHK’s opening press conference where the event’s directors remarked how “excited” they were to follow this “megatrend” that wasn’t just for millennials but “cut across generations,” as they highlighted their partnership with Tezos.

Second-tier auction houses and the dealer sector, however, have been less enthusiastic with only 5% and 6% respectively selling NFTs in 2021, according to the Art Basel report. This data spotlights the real gulf between the generative art community (GAC) and the LAW: lack of acceptance by the highly influential dealer sector. This dynamic was reflected at ABHK itself where Tezos was one of the biggest “Show Partners” and an entire Tezos NFT exhibition was included yet hardly any (I counted one) NFTs were prominently displayed elsewhere by galleries within the massive main ABHK exhibit space.

Dealer sector apathy or even disdain remains a key hurdle, considering gallerists serve as the LAW’s gatekeepers, acting as consultants for both collectors and artists. Without buy-in from this segment of the LAW, a bridge to the GAC would be nearly impossible. In an attempt to add more color to the report’s numbers and gauge gallerist sentiment first-hand, I spoke with several gallerists at ABHK.

On Generative Art Lacking Artistic Merit

“This looks like wallpaper,” quipped one unimpressed gallerist as I showed them a deca.art gallery on my phone, featuring highlights from my own generative art collection. Amusingly, this comment mirrors Louis Leroy’s infamous dismissal of Impressionism from 1874 after viewing Claude Monet’s Impression Sunrise: “Impression! Wallpaper in its embryonic state is more finished!" Wallpaper, both the analog form of 1874 and the digital form of 2022, can be beautiful, sure, but lacks any artistic merit. While the legacy art world (LAW) for centuries has positioned itself as the arbiter of artistic quality, its habit of reflexively dismissing the avant-garde is also well documented.

This “wallpaper” comment echoes a persistent criticism of generative art (and digital art generally) that a computer’s involvement in the creative process somehow diminishes the human artistry and therefore merit. From the very beginning of digital art’s history, “almost any artistic endeavor associated with early computing elicited a negative, fearful, or indifferent response.” Further, pioneering computer artist Vera Molnar described the reaction from her peers to her early work as “scandalized!—I had dehumanized art.” This urge to deride a new artistic movement is consistent with the rapid, instinctive and emotional thinking that Daniel Kahneman describes as “System 1,” which is particularly prone to errors and involves little effort. Do computers actually dehumanize art?

A more controlled, analytical way of thinking uses the slower, more deliberate and rational “System 2” thinking, which is “pieced together by logical judgment and a mental search for additional information acquired through past learning and experience.” For example, artist Iskra Velitchkova turns the notion that computer art is “dehumanized” on its head, asking “Can machines make us more human?” Subjective aesthetics aside, the latest anthropological research suggests they can. Some of the traits that most distinguish human beings from our animal relatives include technological innovation, artistic expression, cooperation and networking. In that sense, what is more human than using technology to express creativity through the global and highly cooperative medium of NFTs?

As Molnar herself puts it, “what’s paradoxical about the computer [is] it actually helps you to bring into the world what you had only imagined, even when you yourself don’t [yet] know what that is. So [the computer] actually humanizes your production — not dehumanizes, but humanizes.”

Finally, as any gallerist knows, assessing artistic merit requires proper setting and context. LAW galleries go to extraordinary lengths to ensure they display physical work in as precise a way as possible to showcase formal elements and properly tell a collection’s story. This same respect afforded to the plastic arts applies to digitally displayed art as well. Setting, lighting, equipment and narrative all combine to create a holistic experience that influences the viewer. Just as a Donald Judd sculpture changes both the space around it as well as the viewer, so too does a Refik Anadol. Both deserve to be viewed in a suitable environment before one ultimately determines their artistic merit.

It was rash and foolish to compare the earliest works of Impressionism to wallpaper or to claim Molnar had dehumanized art. How will art historians look back on these latest LAW snubs?

On Generative Art Lacking Legitimacy

“NFT art is removed from art history. The rest of contemporary art can trace its roots back to over a century,” lectured another gallerist I spoke with at ABHK. To be fair, the broad NFT category is mostly associated today with the various animal collectibles that comprise roughly 80% of NFT volume. Regarding “NFT art”, most in the legacy art world (LAW) are familiar with Beeple’s high price tags but knowledge of generative art does not extend far beyond dollar signs, Fidenza or Ringers.

An MFA is not required to identify the formal influence of Kazimir Malevich and Suprematism on Tyler Hobbs’ Fidenza or Monet’s Water Lilies on Sarah Ridgley’s Memory of Nymphaeas (on display at ABHK). Conceptual influence on generative art is similarly apparent with, for example, Dadaism’s embrace of chance, randomness and generative outputs.

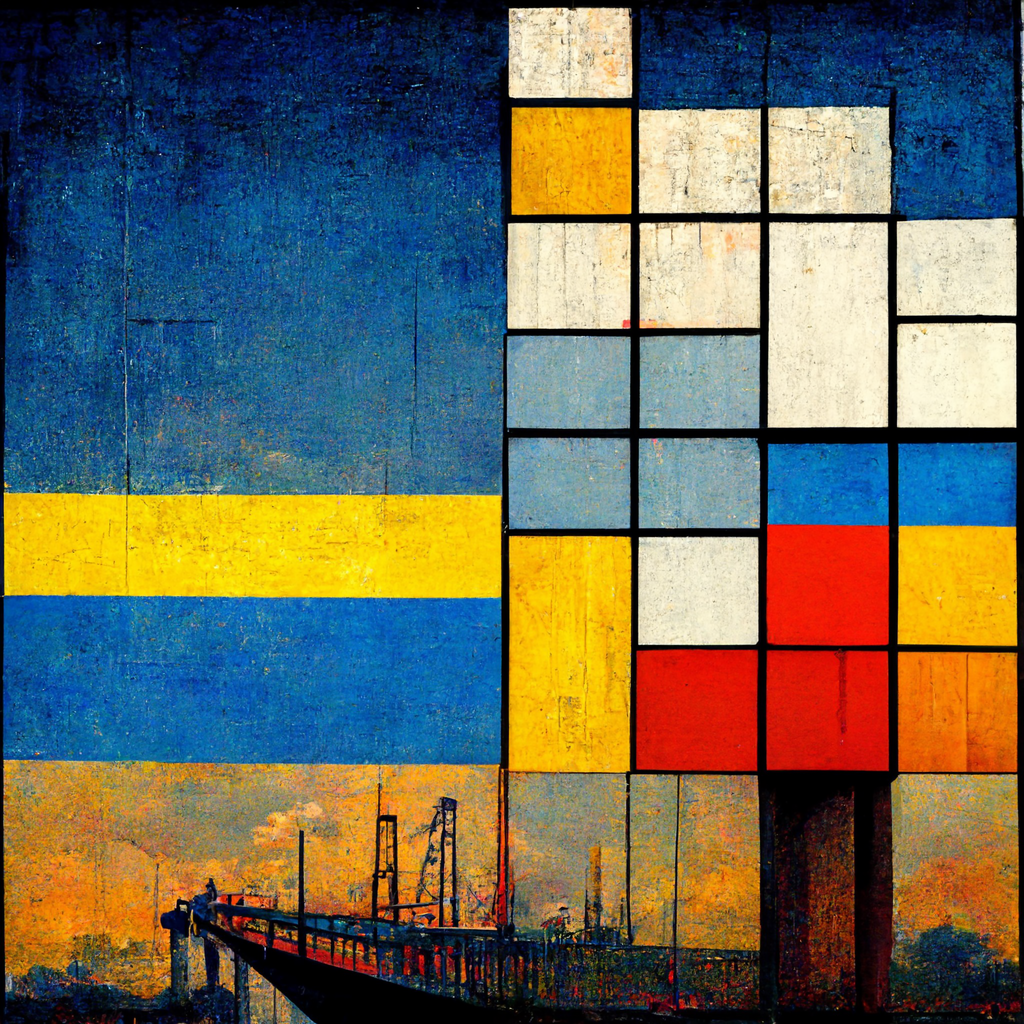

Genealogically, as Jason Bailey has written, there is an undeniable link in the history of modern art’s journey through abstraction to generative art: from Cézanne to Analytical Cubism to Constructivism to Abstract Expressionism to Op Art to Computer art to the generative art of today. We can even identify examples of individual genealogy, for instance, from Malevich to Vasarely (Homenaje a Malevich) to Molnar (GRAV) to Joshua Davis to Jared Tarbell to Matt DesLauriers. Or we can observe more direct links like the ubiquitous influence of the Bauhaus weaving workshop on artists such as Studio Yorktown, Andreas Rau or Lisa Orth as well as the countless generative artists directly influenced by Kandinsky, Mondrian or Rodchenko.

Generative art’s roots in art history are diverse and abundant; communicating this to the LAW will have a profound impact on the future of creativity.

On Bridge Construction

The juxtaposition of the Tezos/fxhash generative art community (GAC) and the legacy art world (LAW) at the four summer 2022 events facilitated the dialogue that will propel the future of creativity.

As recently as five to ten years ago, few could imagine that the LAW would actually need the GAC, but times are changing. On one hand lies a LAW struggling to increase buyers, revenue and relevance in the ongoing digitization of our existence. On the other hand lies the on-chain GAC seeking the capital, legitimacy and inclusion into the canon of art history it believes it deserves. Critically, however, both sides must be willing to engage thoughtfully, diplomatically and humbly to discover their similarities and commonalities.

From the GAC perspective, The LAW may associate NFTs with collectibles rather than fine art, may not understand the tech of blockchains or smart contracts, may not fully grasp the opportunities that NFTs present (royalties, provenance, global markets), may not be exposed to the most cutting-edge generative art and may not be familiar with the robust fxhash and Tezos art communities. Events like Art Basel where the two worlds collide provide robust opportunities to build bridges and engage, for both sides to learn from the other. Education on these topics accelerates at these events but an equally important endeavor remains.

The GAC, in addition to consulting on the topics above, must elucidate, celebrate and communicate the theoretical richness of the generative art movement while highlighting the conceptual parallels it shares with the LAW. Aside from aesthetics, generative art erupts with rich ideas pertaining to technology, art and society, ideas frequently explored in the LAW. Despite the novelty of the NFT’s technological form, the critical discourse remains coextensive.

The GAC can also build a bridge by actively reaching out: become familiar with the canon of art history; go to local galleries, art fairs and museums; speak to gallerists and curators; establish LAW relationships; purchase physical art; explore and celebrate the linkages between our two worlds. If aesthetics and conceptual parallels do not immediately bridge the divide, as has been the case with the LAW and avant-garde movements countless times in the history of modern art, then a proactive approach can highlight commonalities.

Finally, the GAC can build bridges by clearly communicating the mutual benefits of NFTs to the LAW. With associations of scams, apes, crypto bros and techno-babble, the LAW can be rightfully suspicious of how NFTs fit into their space or why they should care. Simple messaging can alleviate that; for example, the acronym ART spells out the value of NFTs to the LAW, buyers and artists:

A: Authenticity: digital certificate that proves genuine ownership for any physical or digital art, including immutable provenance

R: Revenue: expanded buyer base for galleries, 90%+ primary revenue to artists, artist royalties in perpetuity

T: Transparency: open pricing/bidding history and ownership records improve buyer experience, opens up the market and allows for greater participation

In the end, what both communities have in common is that art stirs us, we’re excited about the future of culture and we love supporting artists. NFTs offer expanded possibilities for art, a path to the future of creativity and support for artists like never before. Every person reading this can play a role in building this bridge of appreciation between our two worlds. Art Basel, NFT.NYC and Proof of People were only the beginning.